Agent News

Fundamental Freeway – April 2023

2022 Driver of the Year

We recently announced the winners of our new Diamond Club award. Recipients of the award represent top-performing brokers who exhibit niche expertise in the trucking industry, strong overall performance and exceptional broker partnerships

2022 Diamond Club Award Winners

We recently announced the winners of our new Diamond Club award. Recipients of the award represent top-performing brokers who exhibit niche expertise in the trucking industry, strong overall performance and exceptional broker partnerships.

Diamond Club award winners are well-recognized leaders in the industry, with extensive trucking knowledge and expertise. The 2022 Diamond Club award winners include:

- Amwins

- Cline Wood – a Marsh & McLennan Agency LLC Company

- CRC Group

- HUB International Transportation Insurance Services

“Recognizing the achievements of our Diamond Club winners is always fun and rewarding,” said Rob Westburg, managing director of Fundamental Underwriters. “Fundamental Underwriters could not have achieved our success without our valued partners, and we truly appreciate the outstanding work of these agencies. We cannot wait to see what the future brings.”

We are very grateful for all they did in 2022 to help us achieve another successful year!

The Importance of Claims Reporting

Reporting losses within the first 24 hours can greatly reduce the overall cost of your claim. Delayed filing results in the potential for lost evidence and misinformation, and the involvement of lawyers. These factors could lead to a significantly larger payout. Reporting your losses to your broker or agent first might be appealing, but it can greatly slow the process down, especially if the loss occurs late in the day or on the weekend.

Your first point of contact should be Fundamental Underwriters. There are a number of ways to contact us for non-catastrophic claims:

- Phone number: 1-866-221-0095, option #1 (24 hours a day, 7 days a week)

- Email: [email protected].

Claims that are received via email after 4 p.m. ET may not be responded to until the next business day.

Catastrophic claims must be called in immediately rather than emailed. These include incidents involving multiple vehicles, fatalities and/or injured parties transported by emergency response vehicles, regardless of fault. If possible, we will get someone to the scene right away.

Regardless of the claim severity, the following tips will help you appropriately manage the claims from the onset.

Secure the scene:

- Stop your vehicle

- Turn on your emergency flashers

- Shut off your engine

- Do not move your vehicle until the police arrive

- Set out warning devices to alert other drivers and protect the scene

- Assist the injured, but do not move anyone

- Wait for medical assistance

- Stay at the scene

- Be polite and courteous

Make notifications:

- Dial 9-1-1 to call the police

- Request medical assistance, if needed

- If you are unable to make the call, ask a passerby to call for you

- Contact your employer to report the incident

Document the incident:

- Give your name, address, company name and address, vehicle license number, operator’s license number and insurance information to the police and other parties involved

- Get the contact information of other parties involved, including each party’s operator’s license information, insurance information and contact information

- Get the names and contact information of witnesses

- Secure logs, shipping documents and bills of lading

- Take the following pictures of the scene:

-

- All vehicles, including license plate and cargo involved, especially damage incurred

- People involved, but only if uninjured

- The road from all angles, including stationary objects in the area (signal lights, skid marks, etc.)

- The surrounding area as cameras may be available

- Don’t take pictures of graphic injuries or fatalities

- Don’t sign anything or make any statements except to the police, your company or your insurance provider

- Secure your vehicle from theft and further damage

- Remain at the scene until released by police

- Request a copy of the police report and the responding officer’s contact information and badge number

If you don’t have all of the information, call and provide what you have. We will work with you and other entities to help gather everything we need for the claim. Time is of the essence to get started, so don’t worry if you don’t have that police report just yet.

For Safety lead/dispatch:

- Contact Fundamental Underwriters as soon as possible

- Arrange drug and alcohol testing, if required

- Contact the shop manager or tow truck company, if needed

- Arrange transportation of driver, if needed

- Start preserving all accident materials and equipment

The faster we receive your claim notification, the quicker we can expedite the claim process, reducing the expenses associated with most claims. We value the importance of reducing not only the initial cost of the claim, but your downtime and other associated costs.

If you have any questions, please contact the Fundamental Underwriters Claims team at [email protected].

First Quarter Loss Overview

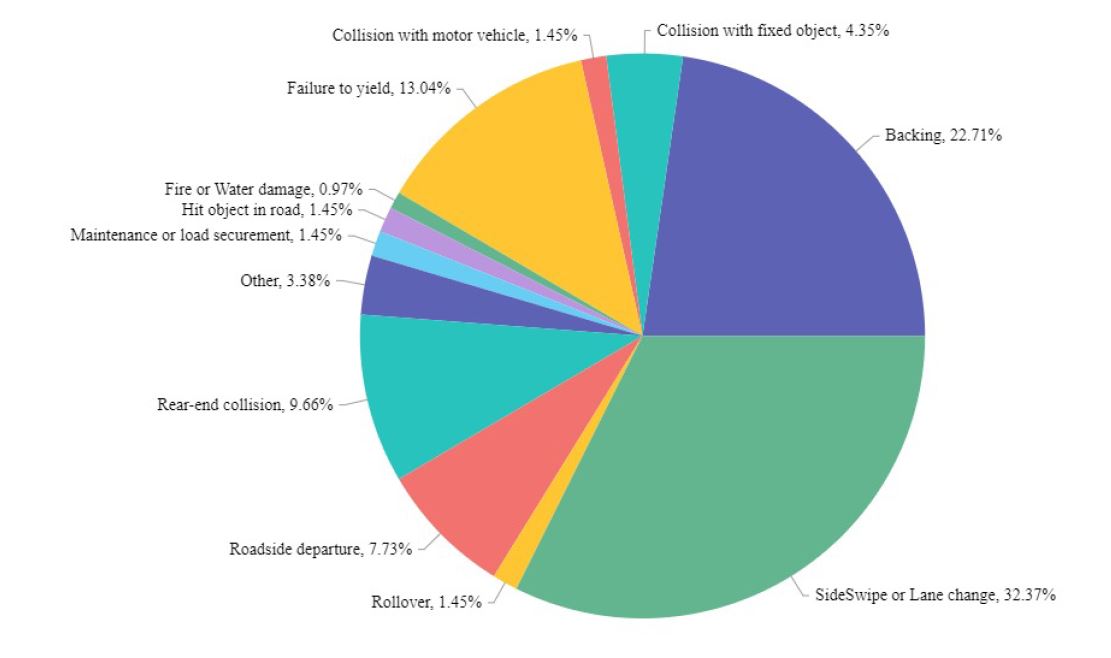

How did your first quarter cause of loss compare to all Fundamental Underwriters policyholders? The chart below represents the top causes of loss in Q1 of this year. To see how you compare, log in to the Claims portal. Please contact your Loss Control consultant if you need assistance.